Table of Contents

Branch office registration in Nepal is a streamlined yet regulated process that enables foreign companies to establish a legal presence and conduct commercial activities within the country. Governed primarily by the Companies Act 2063 (2006) and the Foreign Investment and Technology Transfer Act (FITTA) 2075 (2019), this process is overseen by the Department of Industry (DOI) and the Office of the Company Registrar (OCR).

For foreign enterprises seeking market entry, understanding the Nepal company registration process for branch offices is essential for compliance and efficient setup.

What Is a Branch Office in Nepal?

A branch office is defined as an extension of a foreign parent company that is permitted to conduct full-scale business operations, generate revenue, and engage in commercial transactions within Nepal. Unlike a liaison office (which is restricted to non-commercial activities), a branch office operates as a dependent legal entity with the following characteristics:

- Legal dependency on the foreign parent company

- Authorization to conduct profit-generating activities

- Subject to Nepalese tax laws and regulations

- Requirement to maintain separate accounting records

- Ability to repatriate profits to the parent company through official banking channels

According to Section 154 of the Companies Act 2063, no foreign company may carry on business in Nepal for more than one month without a registered branch office.

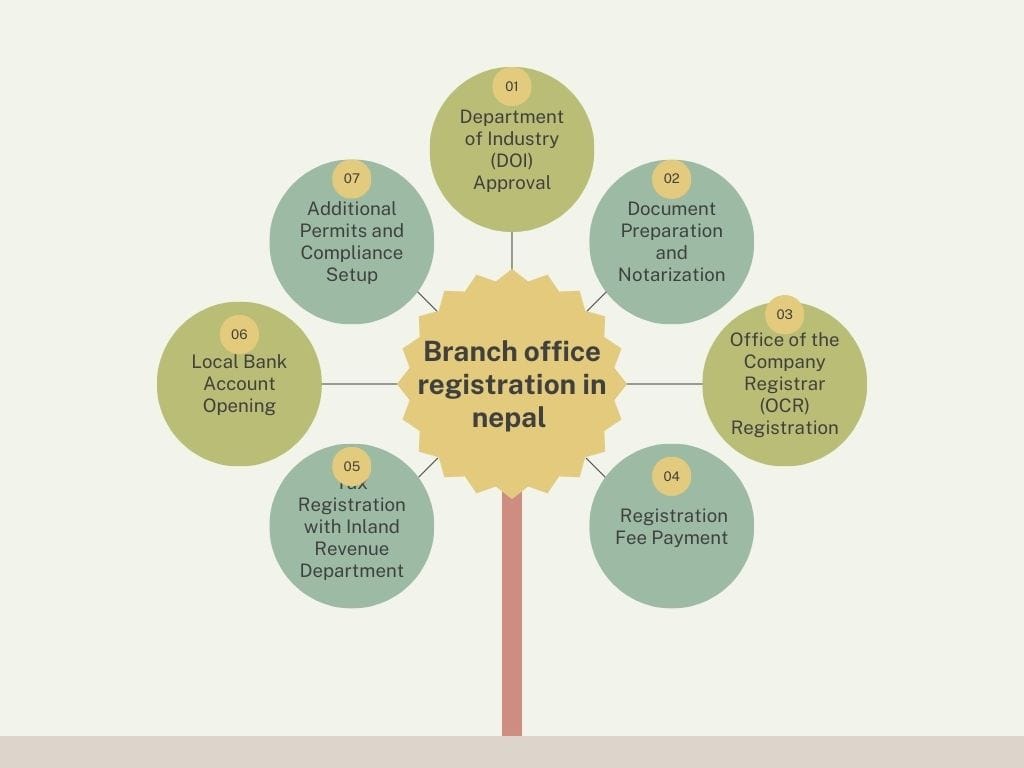

How to Register a Branch Office in Nepal

The branch office registration process in Nepal involves sequential steps across multiple government authorities. The entire procedure typically requires 2 to 8 weeks, depending on document accuracy and departmental workload.

Step 1: Department of Industry (DOI) Approval

The process commences with obtaining approval from the Department of Industry, located at Tripureshwor, Kathmandu. The application must include:

- Detailed business plan outlining proposed activities in Nepal

- Evidence of foreign company selection or contract with Nepali government authority (if applicable)

- Commitment letter regarding investment amount and profit repatriation

The DOI evaluates the application based on sector eligibility, investment amount, and alignment with national economic priorities. Approval is typically granted within 7-14 working days.

Step 2: Document Preparation and Notarization

Comprehensive documentation must be prepared during this phase. All foreign documents require notarization and official Nepali translation. Required documents include:

- Certified copy of parent company’s registration certificate

- Memorandum and Articles of Association (notarized and translated)

- Board resolution authorizing branch office establishment

- Power of Attorney for the local representative

- Passport copies of all directors

- Citizenship certificate of Nepal-based authorized representative

- Proposed organizational structure and business plan

- Latest audited financial statements

- Bank reference letter from parent company’s bank

- Tax clearance certificate from parent company’s home jurisdiction

Step 3: Office of the Company Registrar (OCR) Registration

Upon receiving DOI approval, the application is submitted to the OCR. The OCR maintains both a central office in Tripureshwor, Kathmandu, and provincial branch offices for regional accessibility.

OCR Provincial Office Locations:

- Head Office: Tripureshwor, Kathmandu (serves Bagmati Province)

- Lalitpur Office: Lagankhel, Lalitpur

- Biratnagar Office: Biratnagar, Province 1

- Pokhara Office: Pokhara, Gandaki Province

- Butwal Office: Butwal, Lumbini Province

- Nepalgunj Office: Nepalgunj, serves Karnali and Sudurpashchim Provinces

Applications may be filed through the CAMIS portal or physically submitted at the appropriate office.

Step 4: Registration Fee Payment

Registration fees are calculated based on the proposed investment amount in NPR:

| Proposed Investment Amount (NPR) | Registration Fee (NPR) |

|---|---|

| Up to 10,000,000 | 15,000 |

| 10,000,001 to 100,000,000 | 40,000 |

| 100,000,001 to 200,000,000 | 70,000 |

| 200,000,001 to 300,000,000 | 100,000 |

| 300,000,001 to 400,000,000 | 130,000 |

| 400,000,001 to 500,000,000 | 160,000 |

| Above 500,000,000 | 3,000 per additional 10,000,000 |

If the proposed investment amount is unspecified, a flat fee of NPR 100,000 applies.

Step 5: Tax Registration with Inland Revenue Department

Within 30 days of OCR registration, the branch office must obtain a Permanent Account Number (PAN) from the Inland Revenue Department (IRD) at Lazimpat, Kathmandu. This requires:

- Branch office registration certificate

- Lease agreement or proof of physical office space

- Authorized representative’s citizenship document

- Application for PAN and VAT registration (if applicable)

Step 6: Local Bank Account Opening

A Nepalese rupee (NPR) bank account must be opened with a commercial bank authorized by Nepal Rastra Bank. This account facilitates:

- Capital infusion from parent company

- Operational expense management

- Profit repatriation transactions

- Tax payment compliance

Step 7: Additional Permits and Compliance Setup

Depending on business activities, additional permits may be required:

- Sector-specific licenses (e.g., tourism, telecommunications, financial services)

- Import/export licenses from Department of Commerce

- Labor office registration under Labor Act 2074

- Social Security Fund registration

Required Documents for Branch Office Registration Nepal

The complete documentation checklist for branch office registration in Nepal includes:

Corporate Documents from Parent Company:

- Application for registration at OCR

- Certified registration certificate (notarized and translated)

- Memorandum and Articles of Association (notarized and translated)

- Board resolution for branch establishment

- Company profile and organizational structure

- Latest audited financial statements

- Tax clearance certificate from home country

- Bank reference letter

Local Representative Documents:

- Power of Attorney

- Citizenship certificate of authorized representative

- Passport copies of all foreign directors

- Letter of appointment for authorized representative

- Commitment letter for investment and repatriation

Business Operation Documents:

- Proposed business plan for Nepal operations

- Proof of physical office space (lease agreement)

- Approval/recommendation letter from concerned ministry (if required)

Costs Associated with Branch Office Registration Nepal

Beyond government registration fees, additional costs should be budgeted:

Mandatory Government Fees:

- DOI application fee: NPR 1,000

- OCR registration fee: NPR 15,000 – 500,000+ (based on investment)

- PAN registration: No fee

- Notarization and translation: NPR 5,000 – 15,000

Professional Service Fees:

- Legal consultation: NPR 50,000 – 150,000

- Document preparation: NPR 20,000 – 50,000

- Local representative appointment: NPR 25,000 – 75,000

Operational Setup Costs:

- Office rent (Kathmandu): NPR 50,000 – 200,000/month

- Bank account opening: NPR 5,000 – 10,000

- Initial capital deposit: USD 150,000 minimum (recommended)

Timeline for Branch Office Registration Nepal

The registration timeline varies based on document readiness:

| Phase | Duration | Key Activities |

|---|---|---|

| DOI Approval | 1-2 weeks | Application review and approval |

| Document Preparation | 1-2 weeks | Notarization, translation, attestation |

| OCR Registration | 1 week | Application processing and certificate issuance |

| Tax Registration | 3-5 days | PAN and VAT registration |

| Bank Account Setup | 1 week | Account opening and capital transfer |

| Total Timeline | 4-7 weeks | End-to-end process |

Expedited processing is possible when working with experienced local consultants familiar with inter-departmental coordination.

Compliance Requirements for Operating a Branch Office in Nepal

Post-registration compliance obligations include:

Annual Requirements:

- Submission of audited financial statements to OCR and IRD

- Annual return filing with OCR

- Tax return filing by mid-November each fiscal year

- Renewal of business registration at local ward office

Ongoing Compliance:

- Quarterly VAT returns (if VAT registered)

- Monthly tax deposits for staff withholding

- Maintenance of separate accounting records

- Compliance with Labor Act 2074 for employee matters

- Social security contributions for local employees

Reporting to Nepal Rastra Bank:

- Quarterly foreign exchange transaction reports

- Profit repatriation requests (subject to 15% withholding tax)

- Capital infusion documentation

Key Differences: Branch Office vs. Liaison Office

Foreign companies often confuse branch offices with liaison offices. The distinction is critical:

| Feature | Branch Office | Liaison Office |

|---|---|---|

| Business Activities | Full commercial operations | Non-commercial only |

| Revenue Generation | Permitted | Prohibited |

| Tax Liability | Taxed on Nepal-sourced income | No tax (no income) |

| Governing Law | Companies Act 2063, FITTA 2019 | FITTA 2019, DOI guidelines |

| Minimum Capital | USD 150,000+ | No minimum |

| Registration Authority | DOI + OCR | DOI only |

| Repatriation | Allowed (post-tax) | Expense remittance only |

Branch offices are suitable for companies ready to conduct direct business, while liaison offices serve market research and promotional purposes.

Frequently Asked Questions

How long does branch office registration take in Nepal?

The complete process takes 4 to 8 weeks, depending on document accuracy and departmental processing times. DOI approval requires 1-2 weeks, OCR registration 1 week, and subsequent tax and bank procedures add 2-3 weeks.

What is the minimum capital requirement for branch office registration Nepal?

While the Companies Act 2063 is silent on minimum capital, practical requirements mandate at least USD 150,000 for foreign branch offices to demonstrate financial viability and facilitate operational setup. This capital must be transferred through official banking channels.

Can branch offices repatriate profits from Nepal?

Yes, branch offices may repatriate profits after payment of applicable taxes (15% withholding tax on branch profits remittance). All repatriations must be processed through Nepal Rastra Bank-approved banking channels with proper documentation.

Where are the OCR offices located for registration?

The Office of the Company Registrar operates from Tripureshwor, Kathmandu (head office), with provincial branches in Lalitpur, Biratnagar (Province 1), Pokhara (Gandaki), Butwal (Lumbini), and Nepalgunj (Karnali/Sudurpashchim).

What taxes apply to branch offices in Nepal?

Branch offices are subject to:

- Corporate income tax at 25% on Nepal-source income

- 13% VAT on applicable goods and services

- 15% withholding tax on profit repatriation

- PIT withholding on employee salaries (progressive rates)

Is a local representative mandatory?

Yes, appointment of a Nepali citizen or foreign national with valid work permit as an authorized representative is mandatory for branch office registration and ongoing compliance.

Why Professional Guidance Is Essential

Navigating the Nepal company registration process for branch offices requires expertise across multiple regulatory frameworks. Professional assistance ensures:

- Document Accuracy: Proper notarization, translation, and attestation to OCR standards

- Expedited Processing: Established relationships with DOI and OCR personnel

- Compliance Assurance: Comprehensive understanding of FITTA, Companies Act, and tax obligations

- Strategic Planning: Optimal investment structuring and repatriation planning

- Risk Mitigation: Identification of sector-specific restrictions and approval requirements

Conclusion

Branch office registration in Nepal offers foreign companies a direct pathway to participate in the country’s growing economy. While the process is well-defined through the Department of Industry and Office of the Company Registrar, successful registration requires meticulous documentation, capital planning, and compliance setup.

Foreign enterprises are advised to engage experienced legal counsel familiar with Nepal’s corporate landscape to navigate regulatory complexities efficiently. With proper guidance, branch offices can be established within 4-7 weeks, enabling companies to commence operations and explore Nepal’s market opportunities.

Ready to Register Your Branch Office in Nepal?

Contact our corporate law experts today for personalized guidance through the branch office registration Nepal process. From document preparation to DOI approval and OCR registration, our team provides end-to-end support to establish your business presence in Nepal efficiently and compliantly.

Schedule a consultation with Corporatebizlegal to discuss your specific requirements and receive a customized registration timeline and cost estimate.