Company Registration Nepal Complete Process

Company Registration in Nepal is a fundamental legal process that transforms business ideas into recognized legal entities. As an experienced company registration expert in Nepal with 20 years of practice, I understand that navigating the company registration process can seem complex for entrepreneurs and investors. This comprehensive guide addresses all your questions about company registration in Nepal while providing practical insights based on current legal frameworks and real-world experience.

What is Company Registration in Nepal?

Company Registration in Nepal refers to the legal process of incorporating a business entity under the Companies Act 2063 (2006). This process creates a separate legal identity for your business, providing limited liability protection and enabling formal business operations. The Office of the Company Registrar (OCR) serves as the primary governing authority responsible for overseeing all company registration activities in Nepal.

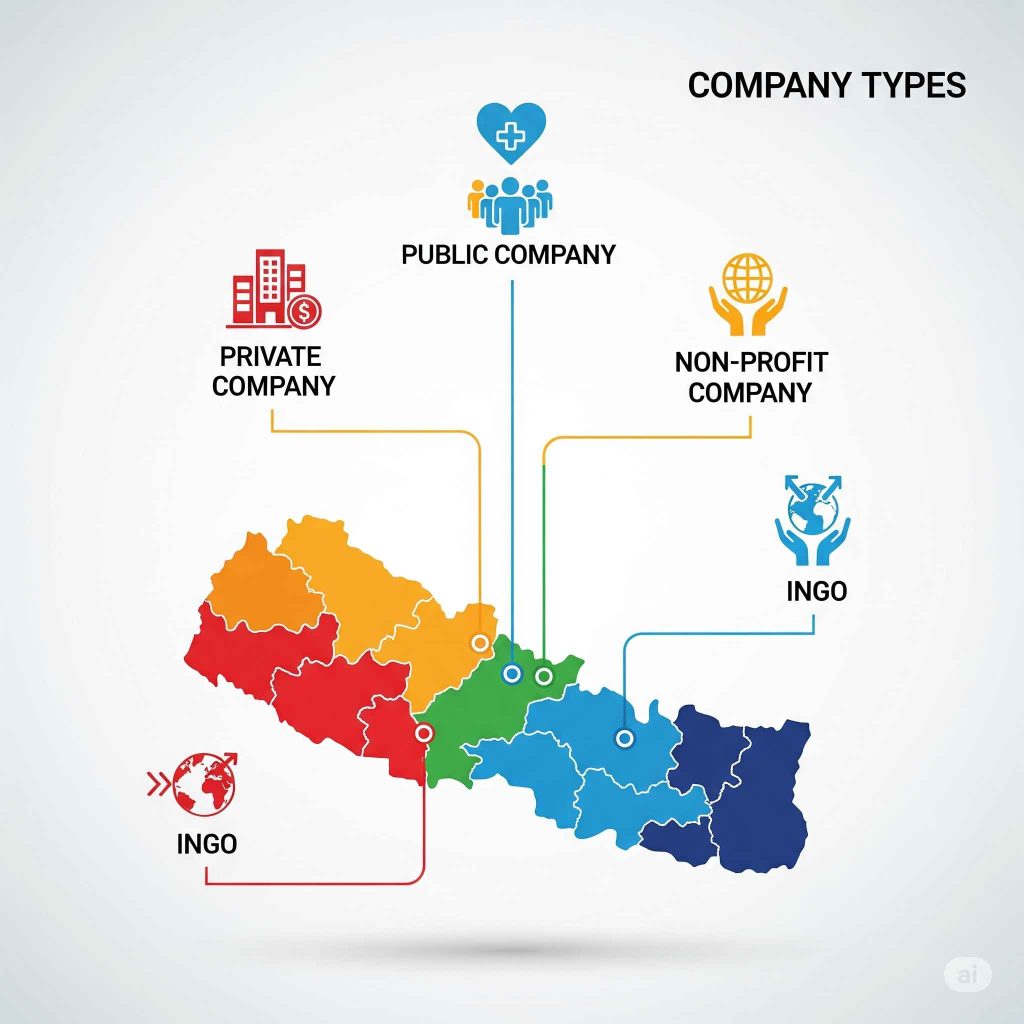

What are the Types of Companies in Nepal?

The Companies Act 2063 recognizes several types of companies that can be registered in Nepal:

Private Company

- Maximum 101 shareholders

- Minimum paid-up capital: NPR 100,000

- Cannot offer shares to the public

- Must include “Private Limited” in the name

Public Company

- Minimum 7 promoters

- Minimum paid-up capital: NPR 10,000,000

- Can offer shares to the public

- Must include “Limited” in the name

Profit Not Distributing Company

- Minimum 5 promoters

- Cannot distribute profits to members

- Established for non-commercial objectives

Foreign Company

- Company incorporated outside Nepal

- Must register branch or liaison office

- Requires approval from Department of Industry

What is the Company Registration Process in Nepal?

The company registration process in Nepal follows a systematic approach that can be completed through the OCR’s online portal. Here’s the step-by-step process:

Step 1: Company Name Reservation

- Visit the OCR Nepal website (application.ocr.gov.np)

- Conduct name availability search

- Submit proposed company name in both English and Nepali

- Name approval typically takes 1-2 days

- Name reservation is valid for 3 months

Step 2: Document Preparation

- Draft Memorandum of Association (MOA)

- Prepare Articles of Association (AOA)

- Create consensus agreement (if applicable)

- Gather promoter identification documents

- Prepare power of attorney (if using representatives)

Step 3: Online Document Submission

- Log in to OCR online portal

- Complete registration application form

- Upload all required documents

- Pay company registration fees based on authorized capital

- Submit application for verification

Step 4: Document Verification

- OCR officials review submitted documents

- Verification process takes 2-3 days

- Additional information may be requested

- Compliance with Companies Act 2063 is confirmed

Step 5: Registration Certificate Issuance

- Upon successful verification, OCR issues registration certificate

- Certificate includes registration number and date

- Private companies can commence business immediately

- Public companies require additional business commencement approval

Step 6: Post-Registration Compliance

- Register for PAN (Permanent Account Number) with Inland Revenue Department

- Complete ward registration at local municipal office

- Obtain necessary business licenses and permits

- Register for VAT if applicable

- Set up share registry for banking purposes

What Documents are Required for Company Registration in Nepal?

The company registration process in Nepal requires several key documents:

Mandatory Documents:

- Application for Registration (prescribed format)

- Memorandum of Association (2 copies)

- Articles of Association (2 copies)

- Consensus Agreement (if applicable)

- Citizenship certificates of Nepali promoters

- Passport copies of foreign promoters

- Passport-sized photographs of all promoters

Additional Documents for Foreign Investors:

- Investment approval from Department of Industry

- Foreign investment permission

- Proof of citizenship from home country

- Incorporation documents of foreign company (if applicable)

Post-Registration Documents:

- Company registration certificate

- PAN registration certificate

- Ward registration certificate

- Rental agreement for business premises

- Tax clearance certificates

What are the Company Registration Fees in Nepal?

The company registration cost in Nepal is structured based on the authorized capital of the company:

| Authorized Capital Amount | Registration Fee (NPR) |

|---|---|

| Up to NPR 100,000 | NPR 1,000 |

| NPR 100,001 – 500,000 | NPR 4,500 |

| NPR 500,001 – 2,500,000 | NPR 9,500 |

| NPR 2,500,001 – 10,000,000 | NPR 16,000 |

| NPR 10,000,001 – 20,000,000 | NPR 19,000 |

| NPR 20,000,001 – 30,000,000 | NPR 22,000 |

| NPR 30,000,001 – 40,000,000 | NPR 25,000 |

| NPR 40,000,001 – 50,000,000 | NPR 28,000 |

| Above NPR 50,000,000 | NPR 3,000 per additional NPR 10,000,000 |

Additional Costs:

- Name reservation fee: NPR 100

- Ward registration: NPR 5,000 – 15,000

- PAN registration: No fee

- Professional service charges: Varies by service provider

- Notary and documentation costs: NPR 2,000 – 5,000

How Long Does Company Registration Take in Nepal?

The company registration timeline in Nepal varies based on several factors:

Standard Timeline:

- Name reservation: 1-2 working days

- Document preparation: 2-3 working days

- OCR verification: 2-3 working days

- Registration certificate: 1-2 working days

- Total standard time: 7-10 working days

Factors Affecting Timeline:

- Document completeness: Incomplete documents delay processing

- Name availability: Common names may require multiple submissions

- OCR workload: Peak periods may extend processing time

- Foreign investment: Additional approvals may extend timeline

- Complex business structure: Multiple shareholders or foreign elements increase complexity

What Legal Frameworks Govern Company Registration in Nepal?

Company registration in Nepal is governed by several key legal frameworks:

Primary Legislation:

- Companies Act 2063 (2006): Main legislation governing company formation and operation

- Companies (First Amendment) Act 2074 (2017): Updated provisions for modern business practices

- Company Rules 2064: Detailed implementation guidelines

Supporting Legislation:

- Industrial Enterprises Act 2076 (2020): Governs industrial business establishments

- Foreign Investment and Technology Transfer Act 2075 (2019): Regulates foreign investment

- Income Tax Act 2058: Tax compliance requirements

- Labor Act 2074: Employment regulations

Regulatory Authorities:

- Office of the Company Registrar (OCR): Primary registration authority

- Department of Industry (DOI): Foreign investment approvals

- Inland Revenue Department (IRD): Tax registration and compliance

- Local Municipal Authorities: Business registration and permits

What are the Post-Registration Compliance Requirements?

After completing company registration in Nepal, businesses must maintain ongoing compliance:

Annual Compliance:

- Annual return filing with OCR within 3 months of fiscal year-end

- Financial statement preparation and audit (if applicable)

- Tax return filing with Inland Revenue Department

- Renewal of business licenses and permits

Ongoing Compliance:

- Maintenance of statutory books and records

- Regular board meetings and documentation

- Share registry updates for ownership changes

- Tax payments and VAT filings (if applicable)

- Employee-related compliance (PF, social security, etc.)

Special Compliance for Foreign Companies:

- Annual reporting to Department of Industry

- Investment reporting to Nepal Rastra Bank

- Repatriation reporting for profits and dividends

- Compliance with foreign exchange regulations

FAQ: Company Registration in Nepal

What is the minimum capital required for company registration in Nepal?

Private Company: Minimum paid-up capital of NPR 100,000

Public Company: Minimum paid-up capital of NPR 10,000,000

Profit Not Distributing Company: No minimum capital requirement specified

Foreign Company: Minimum investment of NPR 50 million for branch office

Where is the Office of Company Registrar located in Nepal?

Head Office: Tirpureshwor, Kathmandu=

Regional Offices: Available in major cities including Biratnagar, Birgunj, Butwal, Pokhara, Nepalgunj

Online Services: Available through application.ocr.gov.np

Working Hours: Sunday to Thursday , 10:00 AM to 5:00 PM

What are the benefits of company registration over proprietorship firm?

Limited liability protection for personal assets

Separate legal entity status

Enhanced credibility with customers and suppliers

Access to funding and investment opportunities

Perpetual succession regardless of ownership changes

Tax benefits and incentives

Easier business expansion and franchising opportunities

Can foreigners register a company in Nepal?

Yes, foreigners can register companies in Nepal

Foreign investment requires approval from Department of Industry

Minimum investment thresholds apply for different business types

Certain sectors have restrictions on foreign ownership

Repatriation of profits is allowed with proper compliance

Visa facilities available for foreign investors and employees

What is the online company registration process in Nepal?

Visit OCR portal: application.ocr.gov.np

Create user account with valid email and mobile number

Reserve company name through online name search

Fill registration form with complete company details

Upload required documents in prescribed format

Pay registration fees through online payment system

Track application status through online dashboard

Download registration certificate upon approval

How can I check my company registration status online?

Visit OCR website: application.ocr.gov.np

Login to your account using registered credentials

Navigate to application status section

Enter application number or company name

View real-time status of your registration application

Download approval documents when availabl

What are the tax implications after company registration?

Corporate income tax: 25% on net profits

VAT registration: Mandatory if annual turnover exceeds NPR 5 million

Withholding tax: Applicable on certain payments

Annual tax return: Must be filed by end of fiscal year

Advance tax payments: Quarterly payments required

Tax audit: Mandatory for companies meeting certain criteria

What are the common mistakes to avoid during company registration?

Rushing name selection without proper availability check

Incomplete documentation leading to multiple resubmissions

Ignoring professional advice to save costs initially

Underestimating capital requirements for business operations

Neglecting post-registration compliance requirements

Choosing inappropriate business structure for long-term goals

Overlooking industry-specific licenses and permits

Conclusion: Expert Recommendations for Company Registration in Nepal

As a company registration expert in Nepal with two decades of experience, I strongly recommend approaching the company registration process with careful planning and professional guidance. The Companies Act 2063 provides a robust framework for business incorporation, but success requires attention to detail and ongoing compliance.

Online Company Registration in Nepal | Education Consultancy Registration in Nepal

Key recommendations for successful company registration:

- Engage professional services for document preparation and submission

- Conduct thorough research on industry-specific requirements

- Plan for adequate capital beyond minimum requirements

- Establish compliance systems from the beginning

- Maintain proper documentation throughout the process

- Stay updated on legal changes affecting business operations

Company Registration in Nepal is more than a legal formality—it’s the foundation of your business success. By following this comprehensive guide and seeking professional assistance when needed, you can navigate the process efficiently and establish a strong legal foundation for your business venture.

Ready to register your company in Nepal? Contact our expert team for personalized guidance and professional support throughout your company registration journey. We offer comprehensive services from name reservation to post-registration compliance, ensuring your business starts on the right legal footing.

Note: This guide provides general information about company registration in Nepal. Legal requirements may change, and specific circumstances may require professional legal advice. Always consult with qualified legal professionals for your specific business situation.

Leave a Reply