Table of Contents

Foreign Investment Approval in Nepal | FDI in Nepal 2025 | Foreign Investment and Technology Transfer Act (FITTA) 2019

Foreign Investment approval in Nepal 2025 has transformed significantly with the introduction of the automatic route system, representing a landmark shift in the country’s investment landscape. The Foreign Investment and Technology Transfer Act (FITTA) 2019, amended in January 2025, has created unprecedented opportunities for international investors seeking to enter Nepal’s emerging market. This comprehensive guide provides everything you need to know about FDI in Nepal 2025, from new policies and regulations to step-by-step procedures and sector-wise opportunities.

New FDI Policies and Regulations for 2025

The Government of Nepal has introduced groundbreaking FDI policies in 2025 that are reshaping the investment environment. The most significant development is the enhancement of the automatic route system, which allows foreign investors to establish businesses without prior government approval for investments up to NPR 500 million (~$37.6 million).

Key 2025 Policy Updates:

- Automatic Route Expansion: The automatic route FDI Nepal system, introduced during the Nepal Investment Summit in April 2024, has been significantly streamlined. Foreign investors can now initiate the process through the online portal at www.imis.doind.gov.np , receiving approval notifications via email within 7-14 days.

- FITTA Amendments January 2025: Recent amendments to the Foreign Investment and Technology Transfer Act have introduced provisions allowing foreign investors to make equity investments through venture capital funds or specialized investment funds registered under the Securities Board of Nepal.

- Provincial Requirement Removal: The requirement for recommendations from provincial ministries has been eliminated, simplifying the approval process for industries registered at the provincial level.

- Agricultural Sector Liberalization: While restrictions remain on specific agricultural sectors (animal husbandry, fisheries, beekeeping, fruits, vegetables, oilseeds, pulses, and dairy), exceptions have been made for large-scale industries utilizing agricultural technology and mechanization that export at least 75% of their products.

Email at – info@corporatebizlegal.com

Call at- +977 9861817739

Step-by-Step Investment Procedures and Requirements

The FDI process Nepal has been significantly simplified under the new regulations. Here’s the complete step-by-step procedure for foreign investors:

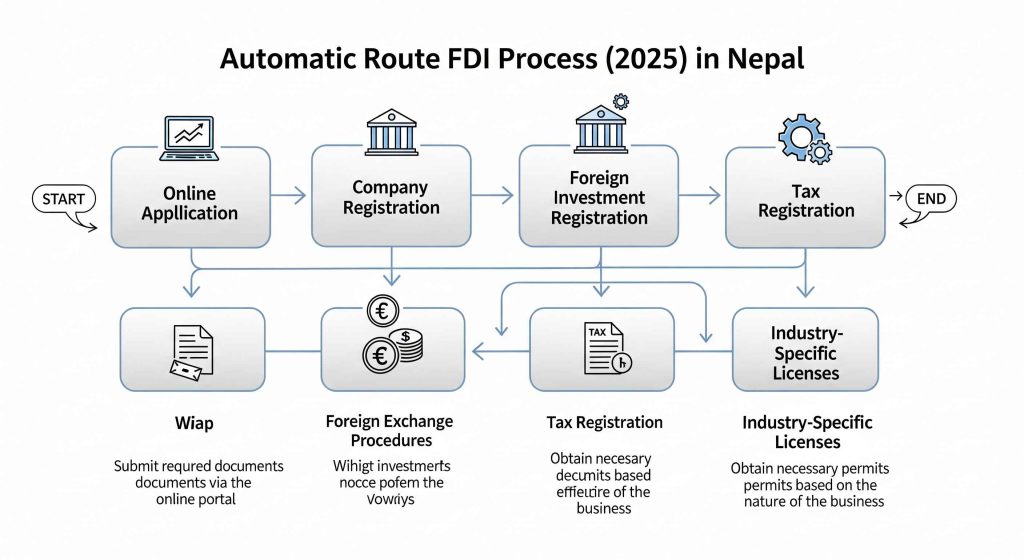

Automatic Route FDI Process (2025):

Step 1: Online Application Submission

- Visit the official portal: www.imis.doind.gov.np

- Register as a new user and complete the application form

- Submit required documents including project proposal and investor details

- Receive application number and approval notification via email

Step 2: Company Registration

- Reserve company name through the Office of the Company Registrar (OCR)

- Prepare Articles of Association and Memorandum of Association

- Submit registration documents to OCR

- Obtain Certificate of Incorporation (typically 3-5 days)

Step 3: Foreign Investment Registration

- Submit foreign investment application to Department of Industry (DOI)

- Provide details of investment amount, sector, and investor information

- Obtain foreign investment approval letter (automatic for investments under NPR 500 million)

Step 4: Foreign Exchange Procedures

- Open foreign currency account with commercial bank in Nepal

- Submit required documents to Nepal Rastra Bank through the bank

- Obtain foreign exchange facility approval

Step 5: Tax Registration

- Register for Permanent Account Number (PAN) with Inland Revenue Department

- Register for Value Added Tax (VAT) if applicable

- Obtain tax clearance certificate

Step 6: Industry-Specific Licenses

- Obtain necessary sector-specific licenses or permits

- Comply with industry regulations and standards

- Commence business operations

Required Documents for FDI Approval (2025):

| Document Category | Specific Documents Required |

|---|---|

| Company Registration | Memorandum and Articles of Association, Notarized passport copy of foreign investor(s), Registered office address proof in Nepal |

| Foreign Investment | Foreign Investment Application Form, Detailed project profile with investment breakdown, Source of funds declaration, Bank certificate of foreign investor |

| Foreign Exchange | Application for foreign exchange facility, Bank account opening forms, Foreign inward remittance certificates |

| Tax Registration | PAN registration application, VAT registration application (if applicable), Details of business activities and expected turnover |

Sector-Wise FDI Restrictions and Opportunities

Understanding sector-wise FDI Nepal restrictions and opportunities is crucial for foreign investors planning to enter the Nepali market in 2025.

Sectors Open for 100% Foreign Ownership:

| Sector | Minimum Investment Threshold (NPR) | Key Conditions |

|---|---|---|

| Manufacturing (except sensitive industries) | 50 million | Technology transfer encouraged |

| Energy (Hydropower above 1 MW) | 500 million | Environmental compliance required |

| Tourism (Hotels, Resorts) | 100 million | Must meet tourism standards |

| Information Technology | No minimum (automatic route) | Data localization requirements |

| Agriculture (excluding contract farming) | 50 million | Land lease restrictions apply |

Sectors with Restricted Foreign Ownership:

| Sector | Maximum Foreign Ownership (%) | Minimum Investment Threshold (NPR) | Additional Conditions |

|---|---|---|---|

| Telecommunications | 80% | 2 billion | Security clearance required |

| Media (Print, Broadcasting) | 51% | 100 million | Content regulations apply |

| Banking and Financial Institutions | 70% | 5 billion | Central bank approval needed |

| Insurance | 70% | 2 billion | Regulatory approval required |

| Real Estate (housing development) | 100% | 500 million | Land ownership restrictions |

Prohibited Sectors for Foreign Investment:

- Cottage industries

- Personal security services

- Arms and ammunition production

- Narcotics and psychotropic substances

- Radioactive materials

- Real estate business (excluding housing development)

- Retail businesses with investment below NPR 200 million

- Primary agriculture (specific sectors with exceptions for large-scale export-oriented industries)

Complete Focus on Nepal’s FDI Law

The Foreign Investment and Technology Transfer Act (FITTA) 2019 serves as the cornerstone legislation governing FDI in Nepal 2025. This comprehensive legal framework replaced the earlier FITTA 1992 and represents Nepal’s commitment to creating a more investor-friendly environment while maintaining necessary regulatory oversight.

Key Provisions of FITTA 2019:

- Definition of Foreign Investment: Investment made in shares, convertible bonds, or loans by a foreign investor in Nepali industries.

- Investor Protection: Protection against nationalization except in the public interest with fair compensation.

- Technology Transfer: Provisions for bringing new technologies, expertise, and management skills to Nepal.

- Repatriation Rights: Foreign investors can repatriate 100% of profits, dividends, and capital gains subject to Nepal Rastra Bank approval.

- Dispute Resolution: Mechanisms for resolving investment disputes through international arbitration.

Supporting Legal Framework:

Several other laws complement the FDI legal framework Nepal:

- Industrial Enterprises Act 2020: Defines business classifications, incentives, and taxation for industries

- Companies Act 2006: Governs company registration, ownership, and operations

- Income Tax Act 2002: Determines tax policies for foreign investments and businesses

- Foreign Exchange Regulation Act 1962: Regulates foreign currency transactions and capital movements

- One Stop Service Act 2017: Aims to streamline business registration processes

Financial Thresholds and Complete Process Coverage

Understanding the financial thresholds Nepal is essential for foreign investors planning to enter the Nepali market in 2025.

Minimum Investment Requirements (2025):

| Investment Type | Minimum Investment Threshold (NPR) | Approximate USD Equivalent |

|---|---|---|

| Manufacturing Industries | 20 million | $150,000 |

| Service Industries | 20 million | $150,000 |

| Technology-based Industries | 10 million | $75,000 |

| Cottage Industries | 5 million | $37,500 |

| Export-oriented Industries | 10 million | $75,000 |

| IT Sector (Automatic Route) | No minimum requirement | – |

Authority Breakdown Based on Investment Amount:

| Investment Amount | Approving Authority | Processing Time |

|---|---|---|

| Up to NPR 500 million | Department of Industry (DOI) – Automatic Route | 7-14 days |

| NPR 500 million to NPR 6 billion | Department of Industry (DOI) | 15-30 days |

| Above NPR 6 billion | Investment Board Nepal (IBN) | 30-90 days |

| Hydropower projects above 500 MW | Investment Board Nepal (IBN) | 30-90 days |

| Special economic zones | Investment Board Nepal (IBN) | 30-90 days |

Complete Investment Process Timeline:

The complete FDI process Nepal typically follows this timeline:

- Online Application Submission: 1-2 days

- Company Registration: 3-5 days

- Foreign Investment Registration: 2-3 days (automatic route)

- Foreign Exchange Procedures: 3-5 days

- Tax Registration: 2-3 days

- Industry-Specific Licenses: 5-10 days (varies by sector)

Total Timeline: 2-4 weeks for automatic route investments

FAQ Section: Common FDI Queries in Nepal 2025

1. What is the minimum FDI requirement in Nepal 2025?

The minimum FDI requirement Nepal varies by sector:

Most sectors: NPR 20 million (approximately USD 150,000)

Technology-based industries: NPR 10 million

Cottage industries: NPR 5 million

Export-oriented industries: NPR 10 million

IT sector: No minimum investment requirement under automatic route

2. How does the automatic route FDI work in Nepal 2025?

The automatic route FDI Nepal allows foreign investors to:

Invest up to NPR 500 million (~$37.6 million) without prior government approval

Submit applications through the online portal www.imis.doind.gov.np

Receive approval notifications via email within 7-14 days

Complete company registration and commence operations within 2-4 weeks

3. Can foreign investors own 100% of a business in Nepal?

Yes, foreigners can own 100% of a business in most sectors including:

Manufacturing industries

Tourism and hospitality

Information technology

Energy and hydropower

Agriculture and agro-based industries However, certain sectors have ownership restrictions such as banking (70%), telecommunications (80%), and media (51%).

4. How long does it take to get FDI approval in Nepal 2025?

The FDI approval timeline Nepal depends on the route:

Automatic route: 7-14 days

Department of Industry route: 15-30 days

Investment Board Nepal route: 30-90 days

5. What are the most attractive sectors for FDI in Nepal 2025?

Based on current FDI trends Nepal 2025, the most attractive sectors are:

Service sector: Rs34.92 billion in commitments

Tourism sector: Rs18.38 billion in commitments

Manufacturing sector: Rs2.74 billion in commitments

Information technology: Rs1.11 billion in commitments

Agriculture and forestry: Rs761 million in commitments

6. Can FDI profits be repatriated from Nepal?

Yes, foreign investors can repatriate 100% of profits from Nepal, subject to Nepal Rastra Bank approval. During the first nine months of fiscal year 2025, foreign investors repatriated Rs1.47 billion in profits.

7. What are the main sources of FDI in Nepal?

The primary FDI sources Nepal are:

China: 45.34% of total FDI share

India: 21.54% of total FDI share

Other significant sources include Hong Kong, South Korea, United States, United Kingdom, Singapore, Spain, and Australia

8. What challenges do foreign investors face in Nepal?

Despite improvements, foreign investors may face challenges including:

Political instability and frequent policy changes

Bureaucratic delays in certain processes

Infrastructure limitations

Labor union disputes

Foreign exchange restrictions

Conclusion: Your Path to Successful FDI in Nepal 2025

FDI in Nepal 2025 presents unprecedented opportunities for foreign investors, with the automatic route system revolutionizing the investment landscape. The 92.65% increase in FDI commitments during the first nine months of fiscal year 2025 demonstrates the growing confidence of international investors in Nepal’s market potential.

The Government of Nepal’s commitment to liberalizing the investment environment, combined with strategic location between India and China, makes Nepal an attractive destination for foreign investment. Key sectors such as services, tourism, manufacturing, and information technology offer substantial growth potential and favorable investment conditions.

For expert assistance with your FDI journey in Nepal, contact our legal team today. We provide comprehensive support throughout the investment process, from initial application to company registration and compliance management. Let our expertise in Nepal’s FDI regulations help you navigate the investment landscape successfully and establish your business presence in one of Asia’s most promising emerging markets.

Take the first step toward your successful FDI investment in Nepal 2025 – contact our legal experts today for personalized guidance and support.