Table of Contents

Foreign Direct Investment in Nepal has emerged as a critical driver of economic growth, bringing capital, technology, and expertise to various sectors of the Nepali economy. With the government’s commitment to creating a favorable investment climate, Nepal has implemented significant regulatory reforms to attract and facilitate foreign investment. This comprehensive guide provides up-to-date information on FDI in Nepal, focusing on recent regulatory changes, sector-specific opportunities in tourism and hydropower, and detailed legal procedures for foreign investors.

Nepal’s strategic location between India and China, abundant natural resources, and growing domestic market make it an attractive destination for foreign investors. The government has set ambitious targets for economic development, with FDI playing a crucial role in achieving these goals. Recent regulatory amendments in 2025 have further streamlined the investment process, making Nepal increasingly competitive in the global investment landscape.

Email at- info@corporatebizlegal.com

Recent Regulatory Changes Affecting FDI in Nepal (2025)

The Government of Nepal has introduced significant amendments to investment laws through an ordinance issued on January 10, 2025, bringing substantial changes to the Foreign Investment and Technology Transfer Act (FITTA), 2019. These recent regulatory changes demonstrate Nepal’s commitment to improving the investment climate and attracting foreign capital.

Simplified Repatriation Process

One of the most significant changes is the simplification of the foreign investment repatriation process:

| Process | Previous Timeline | New Timeline |

|---|---|---|

| Approval for Fund Repatriation | Up to 15 days | 7 days |

| Appeal Resolution | 30 days | 15 days |

The ordinance has also eliminated the requirement for a separate recommendation for foreign currency convertibility, further streamlining the process for foreign investors looking to repatriate their investments.

Expansion of Investment Opportunities

The 2025 amendments have expanded investment opportunities in several ways:

- Specialized Investment Funds (SIFs): Foreign investors can now participate in Specialized Investment Funds upon obtaining approval from the Securities Board of Nepal (SEBON).

- Foreign Currency Loans: Any industry can now borrow loans from foreign financial institutions, providing greater flexibility for project financing.

- Investment Transfer: Foreign investors can transfer partial or total investment amounts to any entity with prior approval from the Department of Industry (DOI), facilitating operational flexibility and corporate restructuring.

New Sectoral Caps and Restrictions

The ordinance has established specific caps on foreign investments in aviation and related sectors:

| Sector | Foreign Investment Limit |

|---|---|

| International Air Services | 80% |

| Domestic Air Services | 49% |

| Training Centers | 95% |

| Repair and Maintenance Services | 95% |

Employee Share Ownership Plans (ESOPs)

Foreign companies operating in Nepal can now offer Employee Share Ownership Plans (ESOPs) to their Nepal-based employees. This provision enables employees to receive shares as part of their compensation without the need to convert them into foreign exchange if the payment is deducted from their pay slip.

Nepalese IT Companies’ Global Expansion

The ordinance allows Nepalese IT companies to invest abroad by opening branches or liaison offices in foreign countries, marking a significant change from previous restrictions. The types of investments Nepalese companies can make include:

| Investment Type | Description | Limit |

|---|---|---|

| Unlisted Foreign Entities | Investments in foreign businesses such as limited liability partnerships, investment funds | No Cap |

| Listed Foreign Entities | Investments in foreign entities listed on a foreign stock exchange | Up to 20% of paid-up capital |

| Funds Earned Abroad | Investments made using funds earned while residing abroad | No Cap |

Sector-Specific Investment Opportunities: Tourism

Nepal’s tourism sector represents one of the country’s most promising areas for foreign direct investment. With eight of the world’s fourteen tallest peaks, rich cultural heritage, diverse landscapes, and a strategic location between India and China, Nepal offers unique investment opportunities in tourism infrastructure, hospitality, adventure tourism, and eco-tourism initiatives.

Nepal’s Tourism Landscape: Market Overview

Nepal welcomed approximately 1.2 million international tourists in pre-pandemic years, with steady growth resuming since 2022. The government’s ambitious National Tourism Strategy aims to increase visitor arrivals to 3.5 million annually by 2030, with corresponding increases in average length of stay and daily expenditure.

Key tourism segments include:

- Adventure tourism (trekking, mountaineering, rafting)

- Cultural tourism (UNESCO World Heritage sites, festivals)

- Spiritual tourism (Buddhist and Hindu pilgrimage sites)

- Eco-tourism and wildlife experiences

- MICE tourism (Meetings, Incentives, Conferences, Exhibitions)

- Medical and wellness tourism

Foreign Investment Provisions in Tourism

The tourism sector has specific provisions for foreign investment:

| Aspect | Details |

|---|---|

| Minimum Investment Threshold | NPR 50 million (approximately USD 378,000) |

| Foreign Ownership Limits | • 100% in hotels, resorts, and most tourism businesses • 51% in travel agencies and tour operators • 80% in trekking agencies |

| Repatriation Rights | Profits, dividends, and invested capital can be repatriated |

| Protection | Against nationalization with national treatment for domestic investors |

Tourism Sectors Open for FDI

1. Accommodation

- Star-rated hotels and resorts

- Boutique accommodations

- Eco-lodges and homestay networks

- Luxury camping facilities

2. Tourism Services

- Tour operations

- Adventure tourism businesses

- Transportation services

- Entertainment facilities

3. Tourism Infrastructure

- Cable cars and ropeways

- Tourism-focused real estate development

- Airport development and upgrades

- Road connectivity to tourism destinations

4. Specialized Tourism

- Medical tourism facilities

- Wellness and yoga retreats

- MICE facilities

Financial Model for Tourism Investment

Capital Structure

- Typical Debt-Equity Ratio: 60:40 for hospitality projects

- Equity Component: Foreign investment (up to permissible limit) and local partners (if applicable)

- Debt Component: Foreign loans (with Nepal Rastra Bank approval), domestic commercial banks, and international financial institutions

Project Costs Breakdown (for Hotel/Resort)

| Cost Component | Percentage of Total |

|---|---|

| Pre-Development Costs | 3-5% |

| Construction Costs | 65-75% |

| Operational Setup | 15-20% |

| Financing Costs | 5-10% |

Key Financial Indicators

| Indicator | Details |

|---|---|

| Investment Per Room | • 3-star: USD 60,000-100,000 • 4-star: USD 100,000-160,000 • 5-star: USD 160,000-250,000+ |

| Revenue Assumptions | • Average occupancy: 60-75% (mature operations) • Seasonality factor: High/Low season variance of 30-50% • Average daily rate (ADR) growth: 5-8% annually • F&B revenue: 30-40% of room revenue |

| Financial Returns | • Typical project IRR: 15-22% • Equity IRR: 18-25% • Payback period: 6-9 years • DSCR requirement: Minimum 1.4x |

Taxation Framework and Incentives

| Tax Type | Rate/Details |

|---|---|

| Corporate Income Tax | 25% (standard rate) |

| Tax Incentives | • 20% rate for tourism businesses outside Kathmandu Valley • 5-year 100% exemption for establishing new international standard hotels in remote areas • Additional 15% exemption for employing more than 100 Nepalese citizens |

| VAT | 13% (applicable on most tourism services) |

| Customs Duty | Exemptions available for hotel equipment not manufactured in Nepal |

| Withholding Tax on Dividends | 5% for foreign investors |

Sector-Specific Investment Opportunities: Hydropower

Nepal’s hydropower sector represents one of the most significant opportunities for foreign direct investment, given the country’s immense water resources and growing energy demands. With an estimated hydropower potential of 72,544 MW, Nepal has only developed a fraction of this capacity, creating substantial opportunities for foreign investors.

Nepal’s Hydropower Potential

Nepal’s gross hydropower potential has been estimated at 72,544 MW, of which only about 3,200 MW has been developed to date. The government has set an ambitious target to generate 28,500 MW of power within the next 12 years, with the aim of exporting electricity across borders.

Current Installed Capacity (as of FY 2023/24)

| Category | Capacity (KW) |

|---|---|

| Total Hydro (NEA) | 583,160 |

| Total Hydro (NEA Subsidiary) | 492,900 |

| Total Hydro (IPPs) | 1,914,772 |

| Total Thermal (NEA) | 53,410 |

| Total Bagasse (IPPs) | 6,000 |

| Total Solar (Nepal) | 106,940 |

| Total Installed Capacity – Grid Connected | 3,152,646 |

| Total Installed Capacity | 3,157,182 |

Cross-Border Electricity Trade

Nepal has entered into significant cross-border electricity trading agreements:

- A long-term agreement with India to export 10,000 MW of electricity over the next 10 years

- A tripartite agreement between India, Bangladesh, and Nepal allows for the sale of 40 MW of power to Bangladesh through India’s distribution network

Regulatory Framework for Hydropower FDI

Approval Authorities

| Project Type | Approving Authority |

|---|---|

| Hydropower projects below 500 MW | Department of Industry (DOI) |

| Hydropower projects above 500 MW | Investment Board Nepal (IBN) |

| Investments above NPR 6 billion | Investment Board Nepal (IBN) |

Key Legislation

- Foreign Investment and Technology Transfer Act (FITTA) 2019: Primary legislation governing FDI

- Electricity Act, 2049 (1992): Regulates electricity generation and distribution

- Hydropower Development Policy, 2001: Outlines strategic vision for hydropower development

- Industrial Enterprises Act, 2020: Provides framework for industrial ventures

- Companies Act, 2006: Governs company formation and operation

Financial Considerations for Hydropower Investment

| Financial Indicator | Details |

|---|---|

| Typical Project IRR | 15-20% |

| Equity IRR | 18-25% |

| Payback Period | 8-12 years |

| DSCR Requirement | Minimum 1.3x |

| Project Life | 35-40 years |

Process for Hydropower Project Approval

The process of obtaining approval for a hydropower project in Nepal involves several steps:

- Conduct a feasibility study of the proposed project site

- Submit a project proposal to the Department of Electricity Development (DoED)

- Obtain a survey license from the DoED

- Conduct detailed feasibility studies including Environmental Impact Assessment (EIA)

- Submit detailed project report for approval

- Obtain generation license from DoED

- Secure Power Purchase Agreement (PPA) with Nepal Electricity Authority

- Obtain FDI approval from DOI or IBN (depending on project size)

- Complete company registration and other legal formalities

- Implement the project according to approved plans and specifications

Legal Framework Governing FDI in Nepal

Foreign Direct Investment in Nepal is governed by a comprehensive legal framework designed to regulate and promote foreign investment while protecting national interests. Understanding this legal framework is essential for foreign investors looking to establish operations in Nepal.

Key Legislation

- Foreign Investment and Technology Transfer Act, 2019 (FITTA)

- Primary legislation governing FDI in Nepal

- Provides the fundamental framework for foreign investment and technology transfer

- Covers areas such as investment approval, technology transfer, and dispute resolution

- Foreign Investment and Technology Transfer Regulations, 2021

- Provides detailed implementation guidelines for FITTA

- Outlines specific procedures and requirements for foreign investment approval

- Industrial Enterprises Act, 2020

- Focuses on promoting and regulating industrial enterprises in Nepal

- Provides incentives for both domestic and foreign investors

- Simplifies procedures for industrial establishment

- Companies Act, 2006

- Governs the establishment and operation of companies in Nepal

- Specifies requirements for registering a company with foreign investment

- Public Private Partnership and Investment Act, 2019 (PPPIA)

- Promotes investment by foreign private sector in infrastructure, construction, and service sectors

- Provides framework for managing projects under public-private partnerships

Governing Authorities for Foreign Investment

| Authority | Responsibility |

|---|---|

| Department of Industry (DOI) | Approves foreign investments less than NPR 6 billion and hydropower projects below 500 MW |

| Investment Board Nepal (IBN) | Approves foreign investments of more than NPR 6 billion or hydropower projects of capacity more than 500 MW |

| Nepal Rastra Bank | Provides final approval for bringing foreign investment into Nepal and regulates foreign exchange transactions |

Detailed Legal Procedures for FDI in Nepal

The process of establishing a foreign direct investment in Nepal involves several steps and requires compliance with various legal requirements. Understanding these procedures is crucial for foreign investors to successfully navigate the regulatory landscape.

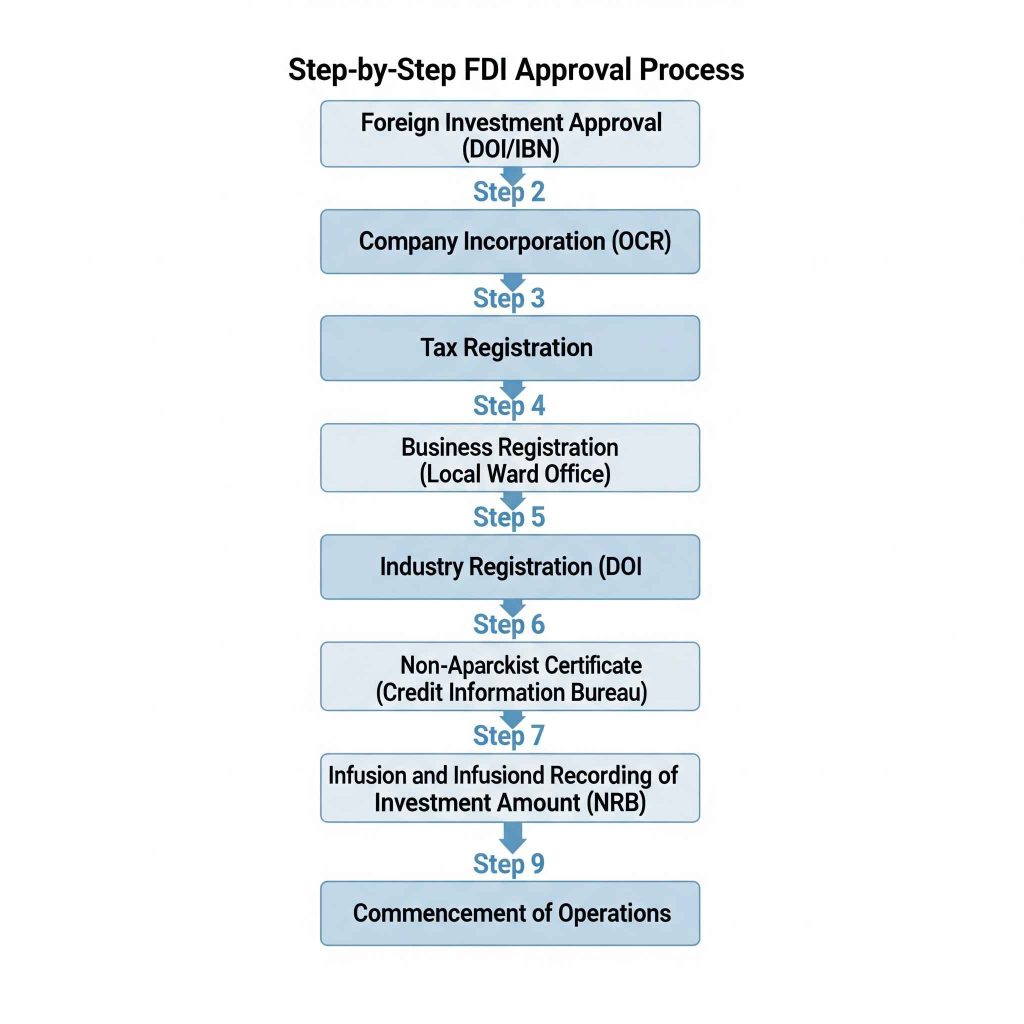

Step-by-Step FDI Approval Process

Step 1: Foreign Investment Approval (DOI/IBN)

Obtain approval for Foreign Direct Investment (FDI) under the Foreign Investment and Technology Transfer Act, 2019 from either the Department of Industry (DOI) or Investment Board Nepal (IBN), depending on the investment amount and sector.

Required Documents:

- Application form for foreign investment approval

- Detailed project proposal and feasibility study

- Joint venture agreement (if applicable)

- Copy of foreign investor’s passport or company registration certificate

- Financial statements of the foreign investor

- Board resolution authorizing the investment (for companies)

- Power of attorney for local representative

- Environmental Impact Assessment report (if required)

- Curriculum vitae of key personnel

Step 2: Company Incorporation (OCR)

Register the company with the Office of the Company Registrar (OCR) under the Companies Act, 2006. This step involves selecting the company structure, reserving a name, and submitting required documents, including Articles of Association and Memorandum of Association.

Step 3: Tax Registration (Inland Revenue Office)

Register the company with the Inland Revenue Office for Value Added Tax (VAT) and Permanent Account Number (PAN) under the Income Tax Act, 2002. This ensures compliance with Nepal’s tax system.

Step 4: Business Registration (Local Ward Office)

Obtain business registration approval from the local ward office as per the Local Governance Operations Act, 2017. This involves submitting company details, lease agreements, and other supporting documents.

Step 5: Industry Registration (DOI)

Register the industry with the Department of Industry as required by the Industrial Enterprises Act, 2020. This step is mandatory for companies engaging in industrial or manufacturing activities.

Step 6: Non-Blacklist Certificate (Credit Information Bureau)

Acquire a “Non-Blacklist Certificate” from the Credit Information Bureau (CIB) under Nepal Rastra Bank’s directives. This certificate ensures that the directors and stakeholders are not blacklisted for financial irregularities.

Step 7: NRB Approval for Investment Amount Infusion

Secure prior approval from Nepal Rastra Bank (NRB) to remit the proposed foreign investment amount as per the Foreign Exchange Regulation Act, 1962. This step includes submitting details of the source of funds, investment plan, and proof of compliance with foreign exchange laws.

Step 8: Infusion and Recording of Investment Amount (NRB)

Infuse the approved investment amount through a local bank, which will issue an Investment Certificate. Subsequently, record the investment with NRB to ensure it complies with foreign currency regulations.

Step 9: Commencement of Operations

After completing all the above steps and obtaining necessary sector-specific licenses, the company can commence operations in Nepal.

Minimum Investment Requirements

| Sector | Minimum Investment Requirement |

|---|---|

| Manufacturing Industries | NPR 20 million (approximately USD 150,000) |

| Service Industries | NPR 20 million (approximately USD 150,000) |

| Technology-based Industries | NPR 20 million (approximately USD 150,000) |

| IT-Based Industries | No Minimum Investment Required |

| Tourism Sector | NPR 50 million (approximately USD 378,000) |

Timeline for FDI Approval Process

| Step | Estimated Time Required |

|---|---|

| Foreign Investment Approval | 7-30 days |

| Company Incorporation | 3-7 days |

| Tax Registration | 1-3 days |

| Business Registration | 3-5 days |

| Industry Registration | 7-15 days |

| Non-Blacklist Certificate | 1-3 days |

| NRB Approval for Investment | 15-30 days |

| Total Estimated Time | 1-2 months |

Documentation Requirements for FDI in Nepal

Proper documentation is crucial for successful FDI approval in Nepal. Foreign investors must prepare and submit comprehensive documentation to demonstrate the viability of their investment and compliance with regulatory requirements.

Essential Documents for FDI Approval

1. Project-Related Documents

- Detailed Project Report: Outlining project background, market aspect, technical aspect, financial aspect, and details of funds

- Feasibility Study: Demonstrating the commercial viability of the proposed investment

- Business Plan: Including marketing strategy, organizational structure, and operational plans

- Environmental Impact Assessment (EIA): For projects that may have significant environmental impact

2. Investor-Related Documents

- Bio-Data/Company Profile: Of the foreign investor

- Copy of Certificate of Registration: And other registration documents (Memorandum of Association, Articles of Association, etc.) of the foreign investor

- Corporate Resolution: Of the foreign investor to invest in Nepal

- Financial Credibility Certificate: Issued by any bank of the country of residence/registration of the foreign investor

- Documents Stating Source of Investment: And time schedule of investment

- Passport of Foreign Investor: In case of individual investor and passports of directors in case of entities

3. Legal and Authorization Documents

- Power of Attorney: Authorizing an individual to complete the approval and registration process

- Commitment Letter: By investor stating that foreign investor shall not repatriate investment till one year

- Joint Venture Agreement: (Not required if the local company will be a fully-owned subsidiary or if the foreign investor is an individual)

Sector-Specific Documentation Requirements

Tourism Sector Additional Requirements

- Tourism Business License: From Nepal Tourism Board (NTB)

- Specific Licenses: Depending on the type of tourism business:

- Hotel/Resort license

- Travel/Trekking agency license

- Adventure tourism operator license

- Municipal Licenses: From local authorities

- Fire Safety Certification: For tourism facilities

- Health and Sanitation Clearance: Especially for accommodation and food services

Hydropower Sector Additional Requirements

- Survey License: From Department of Electricity Development

- Generation License: From Department of Electricity Development

- Power Purchase Agreement (PPA): With Nepal Electricity Authority

- Water Use Agreement: With relevant authorities

- Forest Clearance: If project requires forest land use

- Construction Permit: From local authorities

Challenges and Solutions for Foreign Investors in Nepal

While Nepal offers significant opportunities for foreign investment, investors may face several challenges when navigating the regulatory landscape. Understanding these challenges and their potential solutions is crucial for successful investment in Nepal.

Common Challenges and Practical Solutions

1. Bureaucratic Processes

Challenge: Multiple approvals, lengthy procedures, and bureaucratic red tape can delay project implementation.

Solution:

- Engage experienced local consultants with established relationships with government agencies

- Plan for extended timelines in project schedules

- Maintain positive relationships with authorities through regular communication

- Utilize the One Stop Service Centre (OSSC) at the Department of Industry for streamlined processing

2. Land Acquisition and Ownership Restrictions

Challenge: Land fragmentation, unclear titles, and restrictions on foreign ownership of land can complicate project development.

Solution:

- Establish a local company to hold land ownership

- Conduct thorough title verification through legal experts

- Engage reputable local partners for land acquisition

- Consider long-term lease arrangements as an alternative to purchase

3. Infrastructure Limitations

Challenge: Unreliable utilities, transportation constraints, and limited infrastructure can affect operations.

Solution:

- Invest in backup systems for critical utilities

- Consider self-reliance mechanisms where possible

- Factor infrastructure costs into project financial models

- Explore infrastructure development opportunities as part of corporate social responsibility

4. Regulatory Uncertainty

Challenge: Frequent changes in regulations and policies can create uncertainty for investors.

Solution:

- Stay updated on regulatory developments through legal advisors

- Build flexibility into business models to accommodate regulatory changes

- Engage with industry associations to advocate for stable policies

- Maintain open communication with regulatory authorities

5. Foreign Exchange and Repatriation

Challenge: Restrictions on foreign exchange and repatriation of profits can concern investors.

Solution:

- Understand and comply with Nepal Rastra Bank regulations

- Maintain proper documentation for all foreign exchange transactions

- Plan repatriation in accordance with approved timelines

- Utilize the simplified repatriation process introduced in 2025

6. Limited Skilled Workforce

Challenge: Shortage of skilled labor in certain sectors can affect operations.

Solution:

- Invest in training and development programs for local staff

- Explore options for bringing in foreign experts where allowed

- Partner with educational institutions for workforce development

- Implement knowledge transfer programs

Conclusion: The Future of FDI in Nepal

Foreign Direct Investment in Nepal has reached a pivotal moment, with recent regulatory reforms creating a more favorable environment for international investors. The 2025 amendments to investment laws demonstrate the government’s commitment to attracting foreign capital and expertise, particularly in priority sectors like tourism and hydropower.

Nepal’s strategic location, abundant natural resources, and growing domestic market present compelling opportunities for foreign investors. The country’s immense hydropower potential, coupled with cross-border electricity trade agreements, positions it as a key player in regional energy markets. Similarly, the tourism sector offers diverse investment opportunities, from luxury accommodations to adventure tourism infrastructure.

The simplified regulatory framework, streamlined approval processes, and enhanced investor protections make Nepal increasingly competitive in the global investment landscape. While challenges remain, the government’s proactive approach to addressing these issues and its commitment to economic reform create a positive outlook for FDI in Nepal.

For foreign investors considering entry into the Nepali market, thorough due diligence, local partnerships, and a long-term perspective are essential for success. By understanding the regulatory environment, leveraging sector-specific opportunities, and navigating challenges effectively, investors can capitalize on Nepal’s immense potential for growth and development.

As Nepal continues its journey toward economic prosperity, Foreign Direct Investment will play a crucial role in driving sustainable development, creating employment, and transferring technology and expertise. The future of FDI in Nepal looks promising, with the country well-positioned to attract increasing levels of foreign investment in the coming years.

Disclaimer: This article is for informational purposes only and shall not be construed as legal advice, advertisement, personal communication, solicitation, or inducement of any sort. The information provided herein is based on the latest available regulations and is subject to change. Readers are advised to consult with qualified legal professionals for specific advice related to their investment decisions in Nepal.

Corporate Biz Legal & Company Darta Nepal is a trusted law firm in Nepal, providing expert company registration services in Nepal with full legal compliance and professional support.